What Is an Internal Audit and

How To Conduct One

Auditing — just hearing the word can conjure up images of endless paperwork, scrutiny, and stress. However, internal audits don't have to be a source of fear or frustration. In fact, when done right, they are a powerful tool for improving business processes and ensuring compliance.

In this guide, we'll demystify internal audits by breaking down their types, roles, methodologies, and reporting procedures. We’ll explore how they differ from external audits and give you a simple roadmap for conducting your own.

Let’s dive in.

What is an internal audit?

An internal audit is a critical examination, monitoring, and analysis of an organization’s various functions and systems. Conducted internally by the company’s own audit team, its primary purpose is to assess the effectiveness of the organization's internal controls, risk management, and governance processes.

Conducting regular internal audits offers several benefits:

- Risk mitigation: They help prevent and identify early signs of fraud, waste, or noncompliance with laws and regulations.

- Improved processes: By evaluating the efficacy and effectiveness of operational procedures, internal audits promote continuous improvement.

- Enhanced accountability: Regular audits encourage both frontline staff and managers to maintain discipline in their processes.

- Better assurance: They provide senior management and stakeholders with an assurance that the organization is operating as it should, with reliable financial reporting and compliance with the regulatory environment.

By identifying potential problems, internal audits ensure that the organization is not only complying with laws and regulations but also running as efficiently as possible.

Common types of internal audits

Internal audits can vary widely in their focus depending on the specific needs of the organization.

Here are the most common types:

Financial audits: Focus on the accuracy of the organization’s financial records and to ensure that transactions have been correctly recorded and reported.

Operational audits: Evaluate the efficiency and effectiveness of specific operating procedures and processes.

Compliance audits: Assesses whether the organization is adhering to external laws, rules, and regulations — as well as internal guidelines and policies.

Information technology audits: Examine the controls around the information technology infrastructure to ensure data integrity, security, and availability.

Integrated audits: Combine elements of the aforementioned audits to provide comprehensive insights into the operational, financial, and IT aspects of an organization.

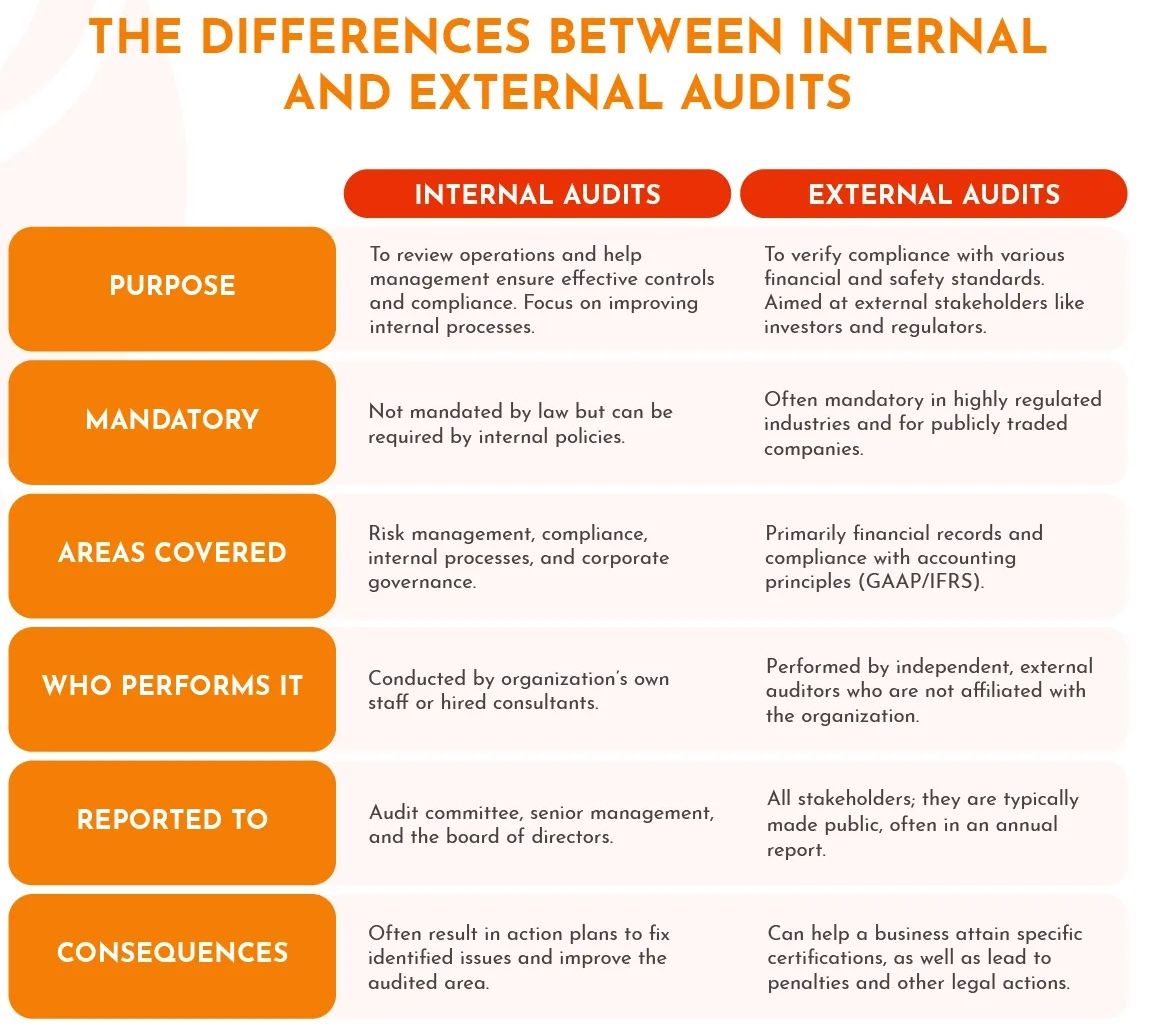

The difference between an internal and external audit

In contrast to internal audits, external audits are often mandatory and have to be conducted by independent auditors. They provide critical assurance to external stakeholders that the company is compliant with various laws and regulations.

The following table outlines the key differences between internal and external audits.

Roles and responsibilities in the audit process

Internal audits can vary in scope depending on the size of the organization and the areas being inspected. Sometimes, it can be a single person doing all the heavy-lifting, while on other occasions, you might need a multidisciplinary team to carry it out.

In general, we can recognize three distinct roles in the internal audit process:

- Internal auditor: Responsible for executing the audit plan by collecting and analyzing data, assessing risk, evaluating internal controls, and investigating any areas of concern. It should be a person who is familiar with the area being audited, but capable of staying objective.

- Audit committee: Typically formed in large organizations as a subset of the board of directors. Their role is to oversee the audit process, review findings, and monitor how the recommendations are being implemented.

- Management: While not directly involved in conducting audits, management is responsible for addressing and rectifying identified issues. Occasionally, they might be asked to allocate resources or provide documentation and insights during the audit process.

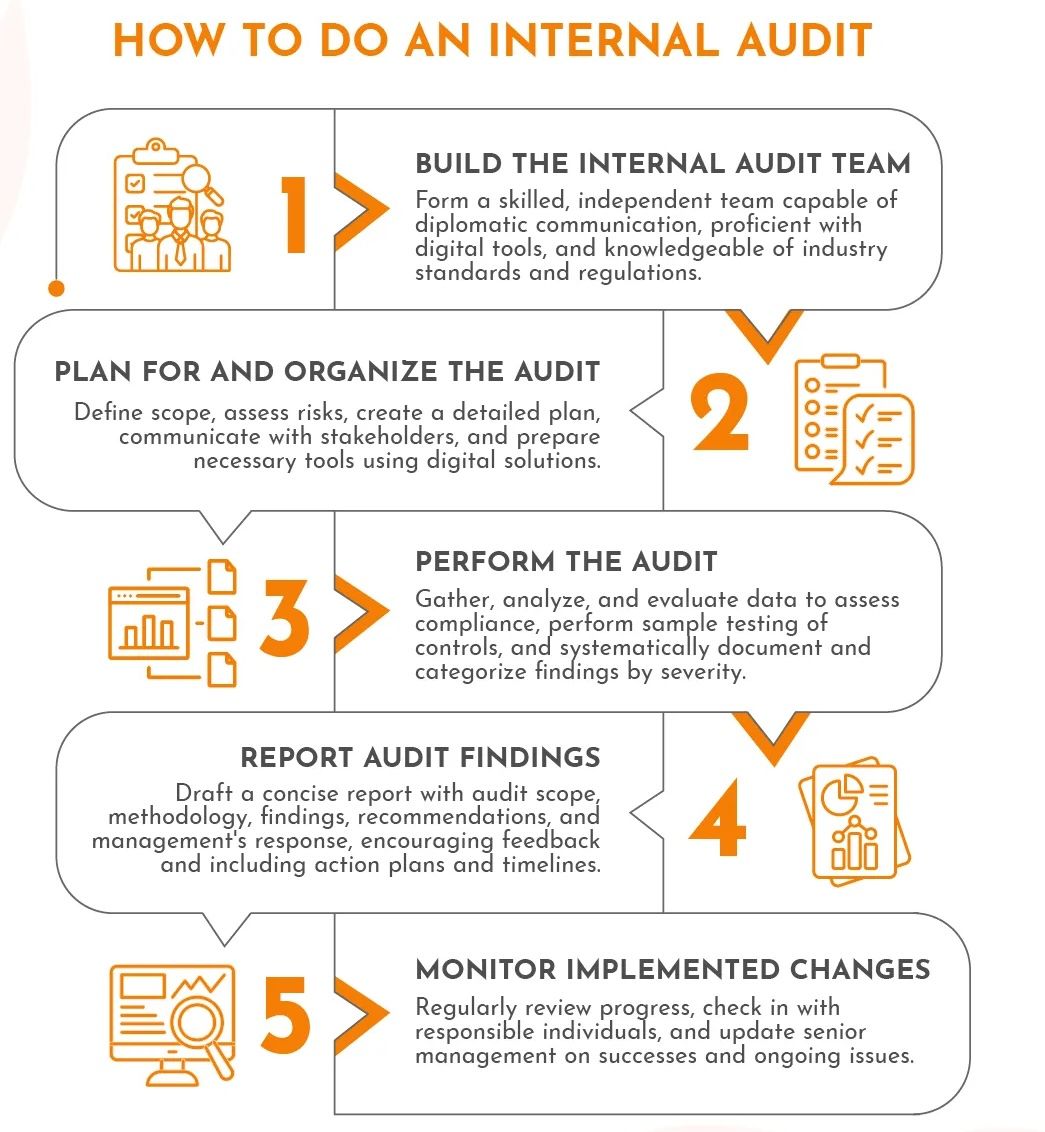

Internal audit methodology: How to do an internal audit

Organizing an audit can seem daunting. However, when you understand the methodology, you’ll see it's nothing to worry about.

An effective internal audit is structured around a series of sequential steps that ensure thorough preparation, execution, and follow-up. Let’s quickly go through each of these steps.

Step #1: Building the internal audit team

Whether it is a single person or a whole team, internal auditors should satisfy certain criteria:

- They should have the necessary skills and knowledge relevant to the areas they will be auditing.

- They should be independent, meaning they will not audit their own work or any projects in which they have a personal stake.

- They should be capable of not only identifying issues but also discussing their findings clearly and diplomatically with various stakeholders.

- They should have a basic understanding of digital tools so they can use mobile devices and software solutions to streamline the process.

- If the internal audit is performed as a preparation for the incoming external audit, they should be familiar with the latest industry standards and regulations.

This step sets the stage for the entire audit process. Here’s how to plan an internal audit effectively:

- Define the scope and objectives: Start by clearly defining what the audit will cover. Determine the areas of the business to be audited, the objectives of the audit, and what you hope to achieve.

- Assess risks: Identify high-risk areas that require more attention during the audit. This helps prioritize audit activities and allocate resources more efficiently.

- Develop the audit program: Based on the scope and objectives, create a detailed audit plan that outlines the audit procedures to be used, the timeline, and the allocation of resources.

- Communicate with stakeholders: Before the audit begins, discuss the goals, scope, and expected outcomes with management and any departments involved.

- Prepare audit tools and resources: Equip your team with the necessary resources they will need to conduct the audit. This might include dedicated audit software, tools for data collection and analysis, and access to necessary documentation and records.

These days, most organizations will use some type of digital tool to digitize and streamline the process through electronic audits.

Step #3: Performing the audit

Once your team is built and the audit plan is set, it's time to perform the audit. This phase is about gathering, analyzing, and evaluating information to assess the organization's compliance with a set criteria.

The auditors will gather data from various sources and carefully analyze it. If they are auditing internal controls (i.e. a digital authorization process or physical controls like key card access), they might perform sample testing to ensure control systems are operating as intended and are capable of preventing or detecting errors.

Throughout the audit, it is crucial to document findings and evidence in a systematic manner. Identified problems should be categorized according to their nature and severity.

Step #4: Internal audit reporting

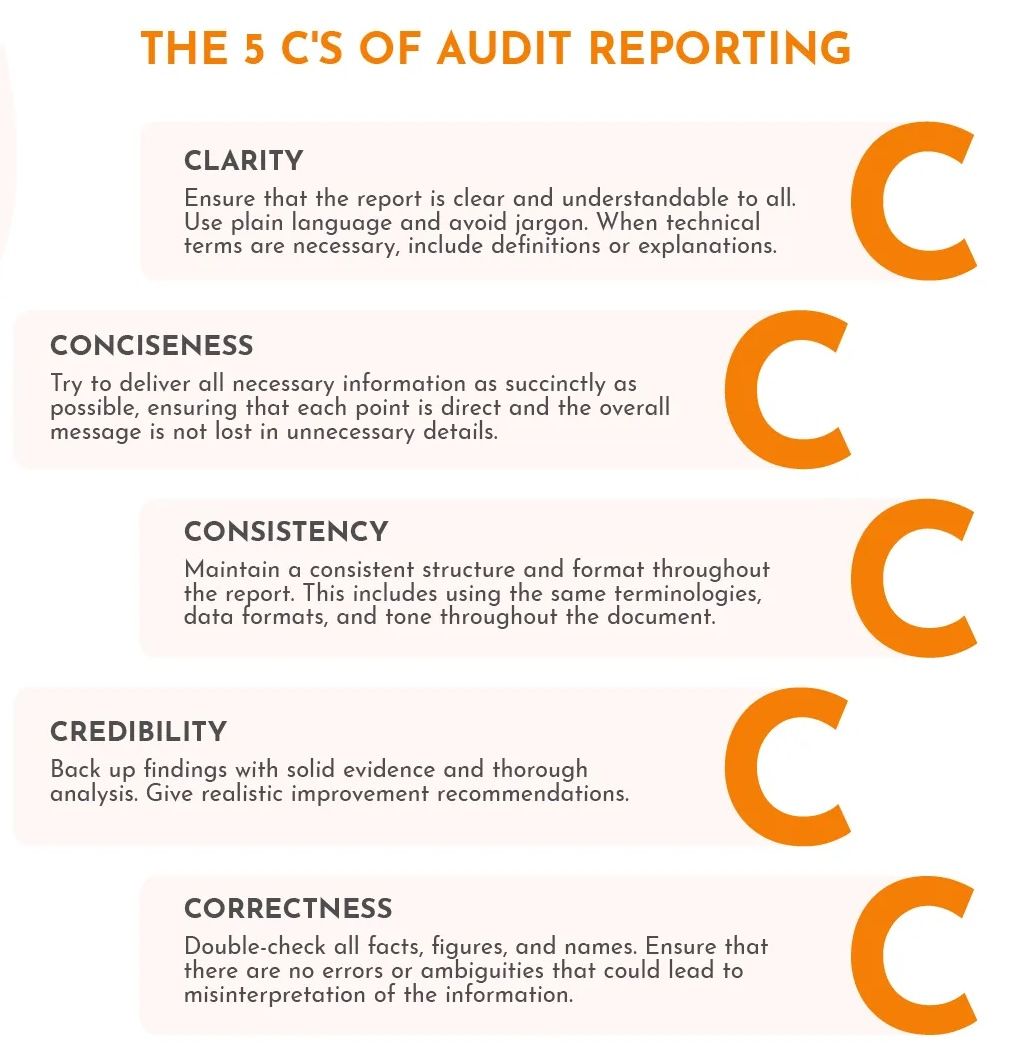

The internal audit report should be clear, concise, consistent, credible, and correct.

For most intents and purposes, the internal audit report should include the following details:

- scope of the audit

- audit methodology

- audit findings

- recommendations for improvement

While presenting the report to management, encourage giving feedback. Open discussion about the findings can help clarify concerns and foster a proactive approach to implementing changes.

The finalized report should also include the management’s response — what actions will be taken, who will be responsible, and the timelines for implementation.

Step #5: Monitoring implemented changes

The effectiveness of an internal audit is ultimately measured by the improvements it generates.

Set up a schedule to review the progress of the recommended actions. This usually involves periodic check-ins with the individuals responsible for implementing the changes.

Lastly, senior management should be regularly updated about progress. These updates should highlight successes, any ongoing issues, and further actions needed if the initial changes have not fully addressed the audit findings.

Simplify internal auditing with eForms Mobile

Internal audits can be immensely beneficial, but they can also be painfully time consuming.

This is where eForms Mobile comes in. Our platform allows you to automate different parts of the audits process by building customizable forms and checklists which auditors can use on any mobile device.

The checklists streamline the process and promote consistency for repeated audits, while digital forms ensure the data is accurate, securely stored, and available in the format that is easily analyzed and reported.

With dozens of pre-made templates for various types of audits that come with our platform, your audits will take less time, be more accurate, and lead to better outcomes.

Learn more by taking our 14-day free trial or request a demo to get a personalized product walkthrough.

FAQ about internal audits

Who can perform an internal audit?

As the name suggests, internal audits are typically conducted by internal teams. People performing them might or might not have specialized training and certifications, such as Certified Internal Auditor (CIA). Additionally, organizations may sometimes hire external consultants, particularly when specific expertise is required or to ensure greater objectivity in the auditing process.

What is an example of an internal audit?

An example of an internal audit could be a financial audit conducted within a corporation to verify the accuracy of its financial records. This type of audit assesses whether financial statements are prepared in accordance with relevant accounting standards and if they reflect true and fair values.

Another example is an IT audit, which examines the adequacy and effectiveness of an organization’s IT infrastructure, security protocols, and data management practices to protect assets and ensure data integrity.

Are internal audits mandatory?

Internal audits are not universally mandatory but are required for certain types of organizations. For example, publicly traded companies are often required to conduct internal audits to comply with regulations such as the Sarbanes-Oxley Act in the US. Additionally, organizations in highly regulated industries, such as banking or healthcare, may be required to have internal audits to ensure compliance with industry standards and regulations.

For other organizations, while not legally mandated, internal audits are considered best practice for effective governance and risk management.

How long does a typical internal audit last?

The duration of an internal audit can vary widely depending on the scope and complexity of the audit, the size of the organization, and the specific areas being audited. A simple audit of a specific process or department might only take a week, while a comprehensive audit of an entire organization could span several months.